Housing prices poised for a reduction, but not crash, as COVID-19 halts rise in homeownership

We expect the recent notable decline in home sales due to the Coronavirus to bring a halt to the steady rise in the homeownership rate, which we saw happening before the Coronavirus began impacting the housing market. Nationally, we expect new and existing home sales will both drop by around 50% between the first and second quarters and only make up part of that drop over the second half of the year.

The good news is that with widespread forbearance in place, foreclosures will be kept to a minimum, so the homeowner rate is unlikely to fall backward. We expect the overall homeownership rate to hold steady at around 65%. However, even after the virus has been brought under control, it will take time for households’ savings and income to recover. Combined with tighter credit conditions, that implies the homeownership rate will rise at a relatively slow pace over 2021 and 2022.

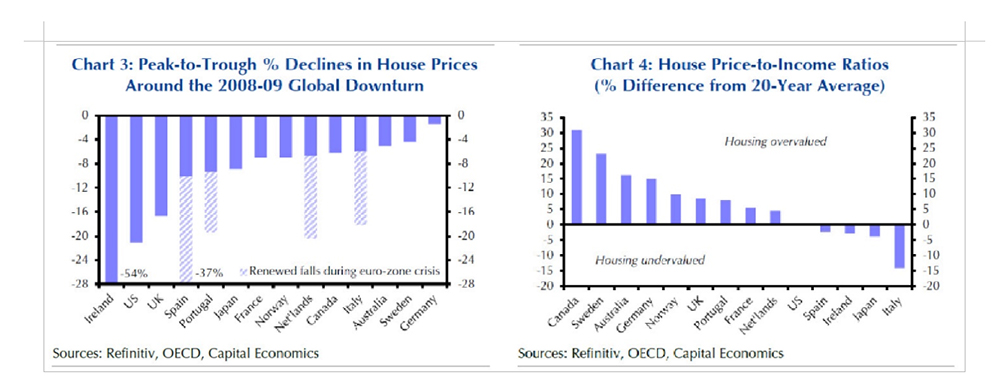

It is important to note that unlike in previous downturns, residential property has not been the root cause this time. Much of the blame for the global downturns in the early-1990s and mid-2000s could be pinned on burst housing bubbles. Years of leveraged over-investment set the stage for house prices to tumble once a shock to interest rates came along, which it did. Overextended households deleveraged to cover debt repayments or defaulted, and mortgage lenders incurred losses. The chickens came home to roost.

The housing market isn’t the villain this time around, but we believe that drops in household income will ultimately deal a blow to housing demand and, therefore, prices. The incomes of would-be homebuyers will probably fall by less than aggregate household income, and income losses will fall disproportionately on low-paid workers in consumer services. They are more likely to be renters than homeowners. Nevertheless, early evidence shows that housing is already taking a hit. In March, US home sales fell the most in over six years.

With the above in mind, it would be overly optimistic to believe that housing prices will escape this recession unscathed. With that said, assuming that policy support proves useful as lockdowns hamper property sales, and if demand rebounds later this year, widespread residential real estate price crashes are unlikely. The risks to our forecasts for smaller-than-10% declines in house prices in advanced economies lie to the downside.

Recall that strong new home sales in 2019 helped the under-35 homeownership rate jump to a nine-year high in the first quarter. But, with the disruption from COVID set to cut home sales in half in the second quarter, that impressive performance is expected to come to a halt. That said, widespread forbearance will keep foreclosures to a minimum, preventing a collapse in homeownership such as that seen after the financial crisis. As a result, we expect the homeownership rate will hold steady at around 65% over the next year.

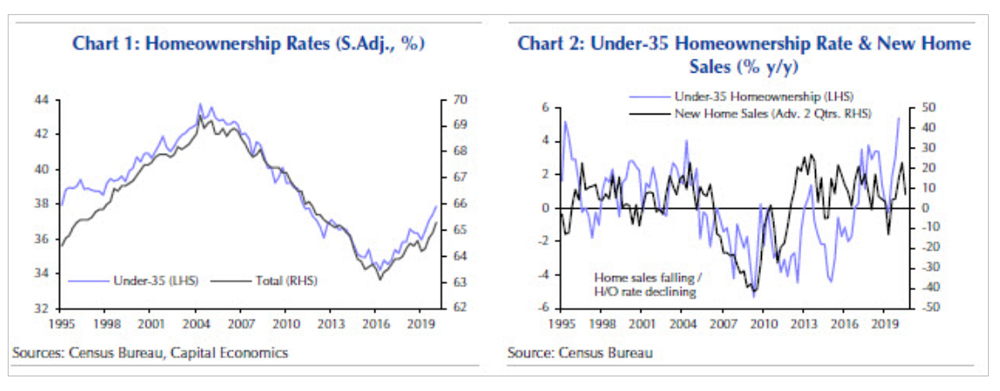

First-quarter Housing Vacancies and Homeownership surveys had some encouraging news for the homeownership rate. After seasonal adjustment, the rate rose to 65.3%, the highest since mid-2012. That rise was driven by increased homeownership among younger Americans. The under-35 rate, defined as the number of owner-occupied homes divided by the number of owned and rented homes, wherein each tenure the head of the household is 35 years old or less, saw its most significant year-on-year gain since records began in 1995 to reach 37.9%. (See Chart 1)

The boost to homeownership among younger Americans reflects the strength of new home sales over the past year. While some existing home sales reflect movements from the rental to homeowner sector, it is sales of new homes that primarily drives changes in homeownership. After all, even if they are not sold directly to first-time to buyers, new sales will free up homes further down the housing supply chain.

Annual growth in new home sales averaged over 11% in 2019, the best performance for three years. Even so, the surge in under-35 homeownership looks high by past standards. (See Chart 2.) It is worth noting that there is a high degree of uncertainty around homeownership rates. The 90% confidence interval around the under-35 rate in the first quarter of 2020 is +/- 0.7. Taking the lower end of that range, the annual growth rate would be more in line with new home sales.

As lockdowns cause housing transactions to fall, house price indices may be unreliable in the near term. It’s tricky to retrieve price data for goods that aren’t being bought and sold in large quantities. Over the year, though, we should see house price falls in all advanced economies around the world. For now, we expect house price declines of about 5%, on average, rather than deep crashes, for three reasons.

- Policy measures, both past, and present should minimize the risk of mass foreclosures. Stricter affordability checks over the last decade mean that households are better able to cope with debt repayments in the face of an income shock than was the case in the past. Today, mortgage holidays, coupled with lower interest rates and government income support, mean that homeowners have more space to weather the storm. All this should limit the scale of forced selling by those unable to meet their obligations to creditors.

- Even for those who want to sell, many will struggle to do so. The lockdowns have erected practical barriers to selling real estate, at least in the near term. For instance, social distancing has put a stop to home viewings and has restricted valuations by surveyors. Further upstream, supply chain disruptions and a largely furloughed workforce have hindered the supply of new homes for sales by developers. So, while housing demand will fall, there could be some offsetting effect on prices from restrictions to adequate supply.

- Our macroeconomic forecasts imply that much of the hit to housing demand will be short-lived. Admittedly, we are forecasting a deep global recession and expect it to take years for incomes to recover to where they would otherwise have been, if not for the Coronavirus. However, our working assumption is that containment measures will soon be eased, which will allow economies to begin recovering in relatively short order, especially compared to the more drawn-out slump in the aftermath of the global financial crisis. A recovery in demand in the second half of 2020 should put a floor under house prices before self-reinforcing declines in price expectations have the chance to set in.

With that said, the risks to our house price forecasts lie to the downside. While we don’t anticipate price crashes like the US, UK and Ireland experienced around the time of the financial crisis (see Chart 3), the risks are more significant in the likes of Canada and Sweden, where residential property is expensive (See Chart 4). More generally, given the genuine threat of a second wave of the virus, containment may well drag on for longer than we envision. Government support is more likely to be less, rather than more, effective at propping up household incomes than we assume.

Similarly, households are more likely to surprise us by being more cautious about buying houses, not less. If the recession bores a bigger hole in lenders’ balance sheets than we’ve accounted for, liquidity support from central banks may not be enough to ensure the supply of mortgage credit that will be needed to facilitate recovery in housing demand.

You might also want to read the following articles for more information about how the Coronavirus is impacting the Southern California real estate market, and some helpful tips for home buyers, homeowners, owners of investment properties, and seller of a home or investment property, can make the most of this new real estate market.

- How The Coronavirus Is Impacting Southern California Real Estate

- Pandemic Continues To Wreak Havoc On Real Estate Market And Broader Economy

- Four Tips On How You Can Make The Most Of This New Real Estate Market

- Navigating The Landlord-Tenant Relationship During The COVID-19 Pandemic

About the author: Omid Yousofi, is a Realtor and Principal Partner of Titan Pacific Group, Inc., a real estate sales and investment firm based in Corona del Mar (Newport Beach), California. He has a proven track record of success representing buyers, sellers, and investors of residential, multifamily, and commercial real estate throughout Southern California with a focus on Orange County, San Diego County, and Los Angeles County. Omid’s ability to guide his clients toward success throughout such a wide-array of real estate property classifications stems from his extensive and diverse background of educational and career experiences which includes earning a Bachelor of Sciences degree in civil engineering with an emphasis in construction management from the University of Southern California as well as a Juris Doctorate in Law from the Thomas Jefferson School of Law. Licensed by the California Department of Realtors in 2005, Omid’s accomplishments include receiving HomeLight’s Top Negotiator Award, for among other things, negotiating the single most significant purchase price reduction in Newport Beach (as a Buyer’s Agent) and for setting the second-highest price per square foot sale in the city of Mountain View (as a Listing Agent). Omid is also a Best of HomeLight award recipient, which is reserved for the top 1% of Realtors based on closed sales volume. Omid’s professional experience includes leading Southern California Infrastructure sales for a Fortune 150 Company (the largest publicly traded engineering, procurement, construction, and public-private-partnership developer in the world).